The Future of Finance in Insurance

Published November 15, 2024

- Insurance

What risks do CFOs face, and how can they transition from a tactical to a strategic role to become essential partners to the CEO?

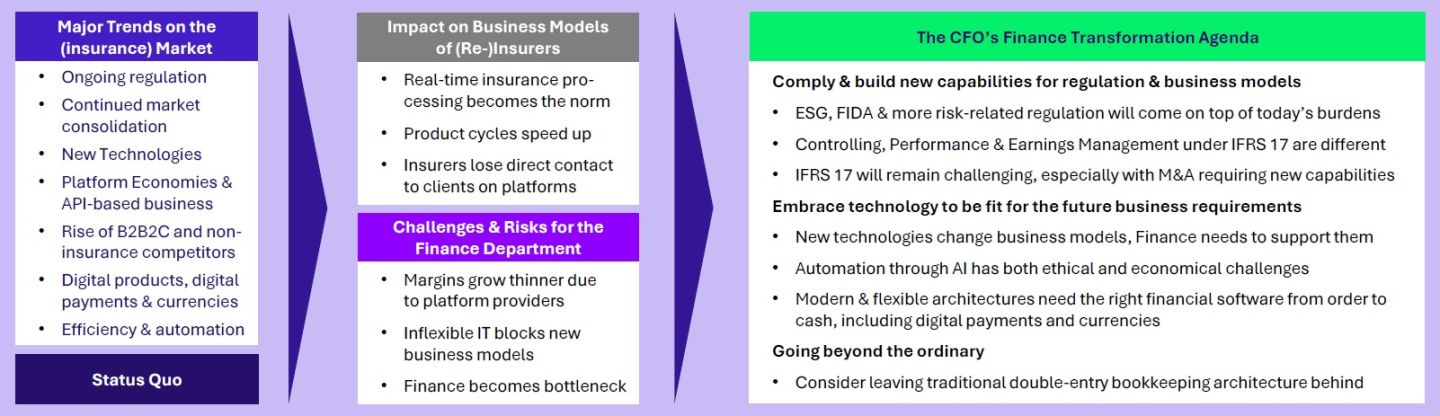

For over a decade, finance investments have largely prioritized regulatory compliance. However, evolving business models and external pressures – such as climate change, geopolitical instability, and cyber security – necessitate a strategic shift. The advent of new technologies and the rise of platform economies require CFOs to go beyond compliance, making strategic investments that enhance operations and drive growth.

Key trends in compliance, architecture, business capabilities, and technological advancements are reshaping the future of the Finance Target Operating Model (TOM).

Despite ongoing internal challenges – such as the need for increased automation and a skilled workforce – Finance must adapt to these external pressures. This organizational debt requires substantial investments in technology and may drive near- and offshoring strategies.

The future of finance demands adaptability. CFOs who embrace technology and streamline operations will lead their organisations to success in a complex landscape.