Mandatory electronic invoicing for businesses: Public or private platform, what to choose?

Published December 18, 2024

- Corporate Finance & HR, Risk & Procurement

French ordinance no. 2021-1190 of September 15, 2021, on the generalization of electronic invoicing requires companies to dematerialize invoices (using a structured format) and transmit e-reporting information (purchases and sales) to the tax authorities according to a timetable that depends on the company’s size (2024-2025-2026). To do this, invoices will have to pass through a Partner Dematerialization Platform (PDP) or the French government’s Public Billing Portal (PPF).

What requirements, and when?

- Mandatory receipt of invoices: all French companies will be required from July 1, 2024, to be able to receive and accept invoices in the formats specified by the tax authorities.

- Mandatory transmission of specific incoming invoicing data (e-reporting): for goods or services purchased (excluding imports) from a B2B foreign operator in the EU and outside the EU for which the purchaser is subject to VAT and established in France.

- Mandatory dematerialized invoices in the format determined by the Direction Générale des Finances Publiques.

- Mandatory transmission to the tax authorities according to a phasing-in schedule based on company size (large companies on July 1, 2024 / medium-sized companies on January 1, 2025 / small and medium-sized companies on January 1, 2026).

- Mandatory e-reporting of B2B and B2C sales and payment status (similar timetable to outgoing invoices: 2024/2025/2026).

PDP platform or PPF portal? A process maturity issue rather than a tool choice

Electronic invoices are issued, transmitted and received either via the public invoicing portal (PPF), which is an evolution of the Chrorus Pro portal currently used for BtoG (Business to Government) transactions, or via a partner dematerialization platform (PDP), a state-certified private solution provider for issuing and transmitting invoice and e-reporting data.

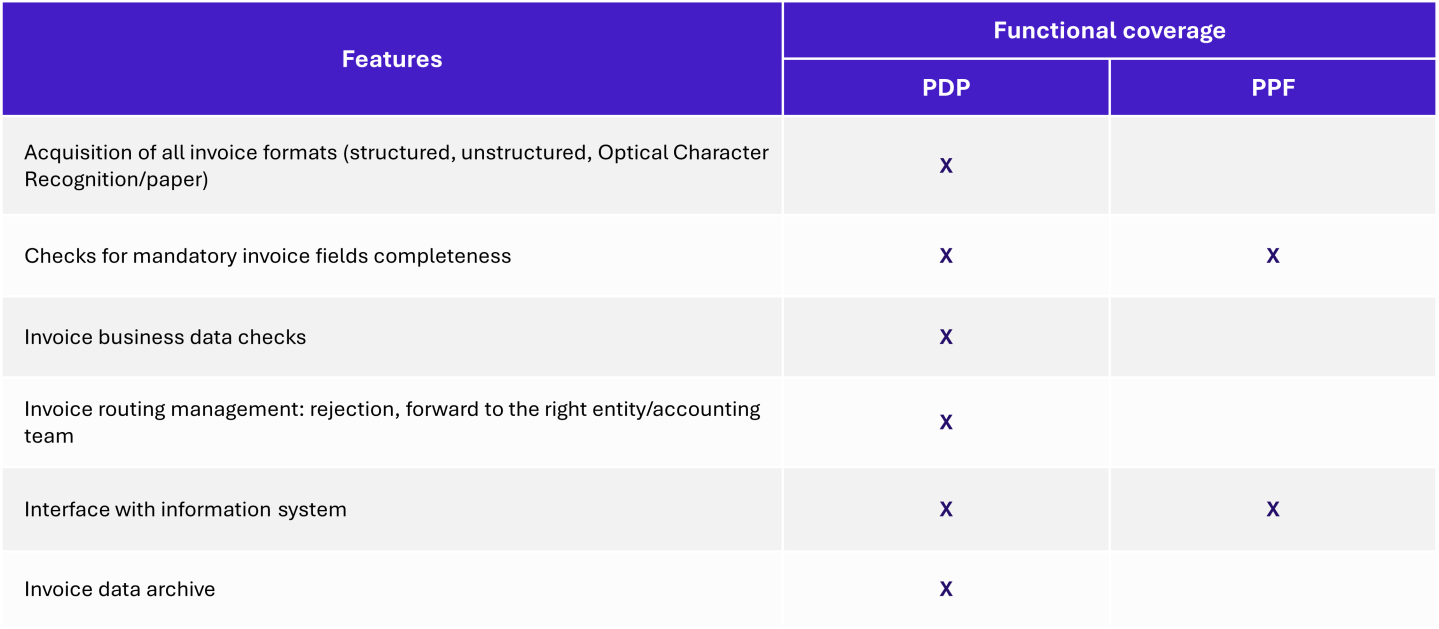

The choice between the Public Billing Portal (PPF) or a Partner Dematerialization Platform (PDP) depends on your level of invoice management maturity, which will determine the functional coverage you need.

The PPF features are focused on meeting legal obligations (see above). PDPs, with different offerings, promise to improve the fluidity and efficiency of invoice management processes.

The following questions can help you assess your level of maturity.

Tool maturity

- Do you already have a Procure to Pay solution for supplier invoices management?

- Do you already have a solution for dematerializing client invoices?

- How often do you use EDI (electronic data exchange) invoices with your suppliers and customers?

- Do you already use EDI for tax purposes? Which tools do you use?

- For outgoing invoices, what formats do your management information systems use?

Process maturity

- Are your internal validation/workflow processes already paperless?

- Are your orders received in a tool and automatically reconciled with the supplier invoice?

- Do you provide an invoicing or self-billing portal to your customers and suppliers?

- How do you manage your invoices? Accounting Shared Services Center? Dedicated EDI unit?

Teams’ maturity and satisfaction with Chrorus Pro portal for BtoG invoices

- Invoice flow to Chrorus Pro already sent and monitored by a dedicated team

- What are your current performance and satisfaction levels with Chorus Pro?

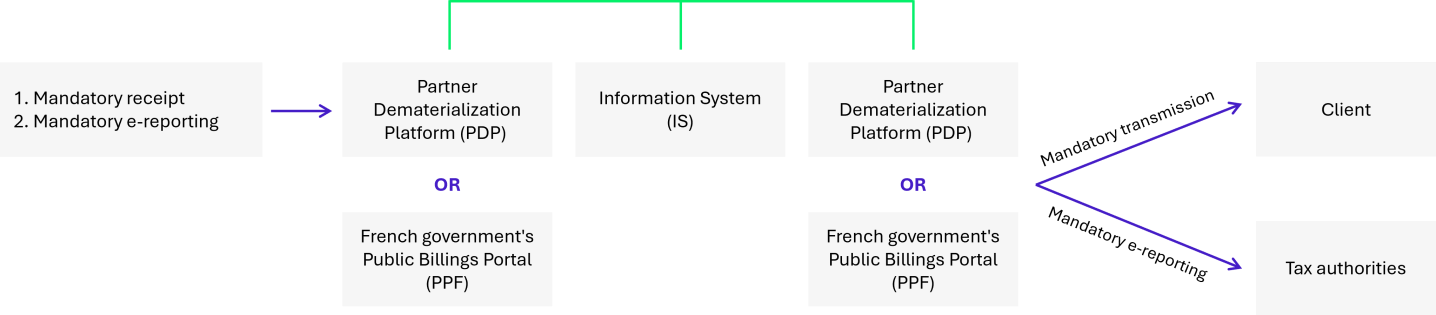

What data transmission schemes?

As part of the reform, the administration has also clarified the 4 possible billing data transmission schemes, via the PPF and/or a PDP.

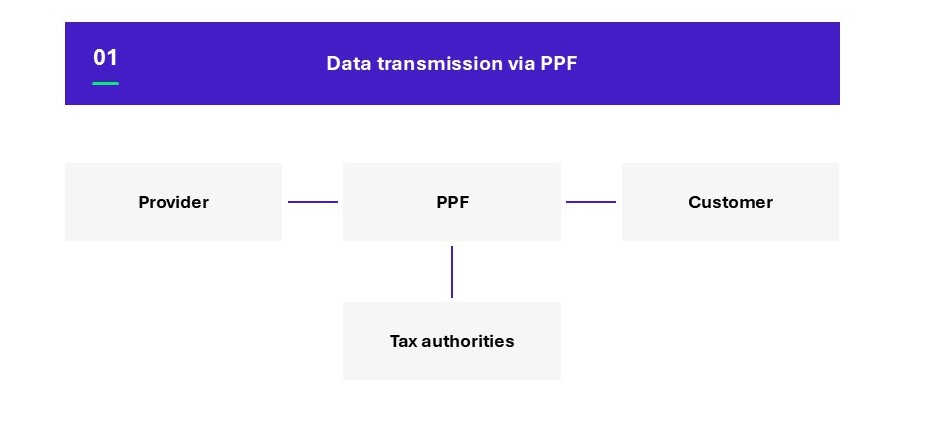

1. Data transmission via PPF

Customer and supplier go through the PPF, which sends invoicing and e-reporting data to the tax authorities.

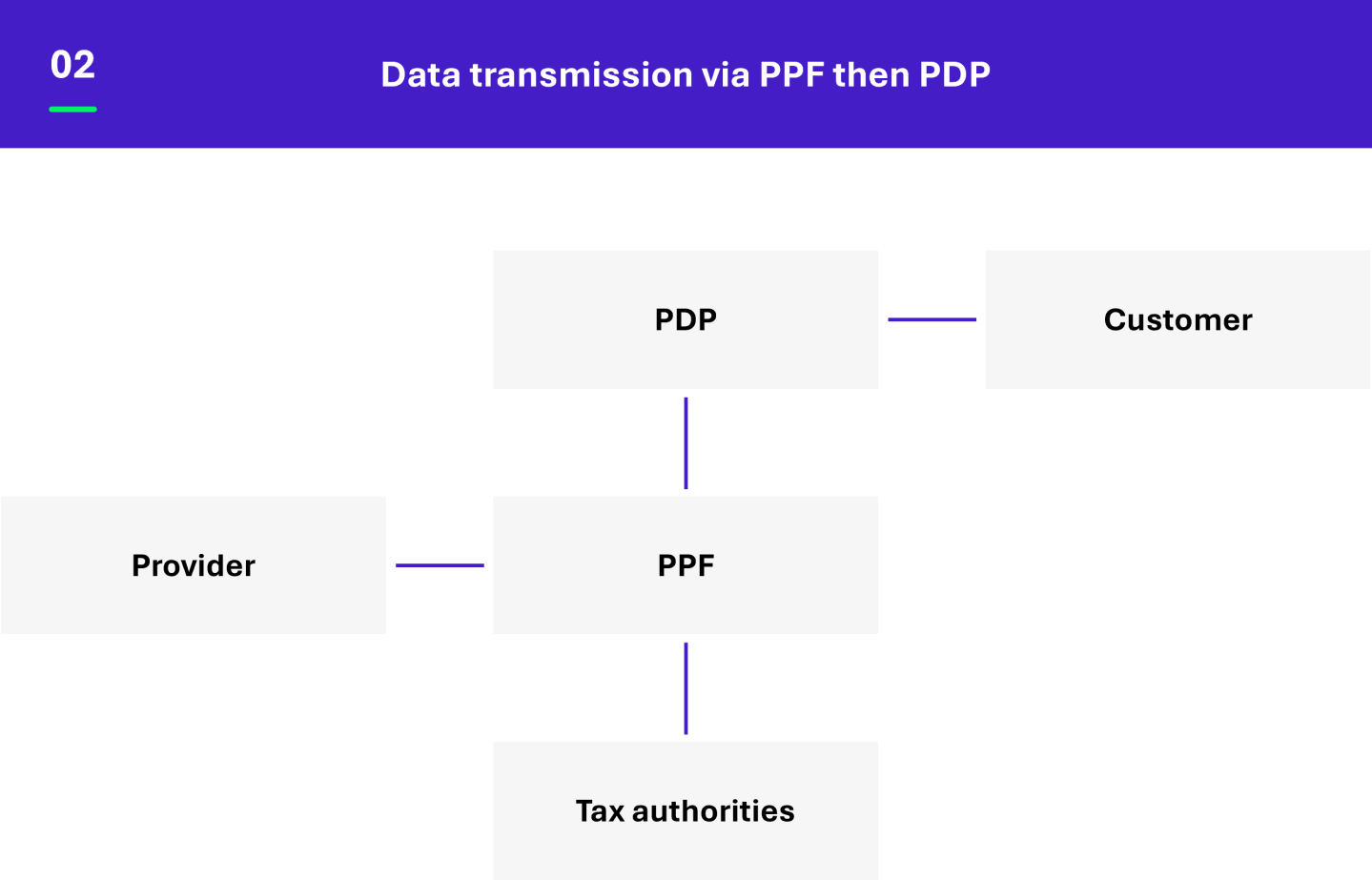

2. Data transmission via PPF then PDP

The supplier issues an invoice via the PPF. The PPF sends this invoice to the customer’s PDP and forwards invoicing data to tax authorities. The customer’s PDP sends back the invoice to the supplier.

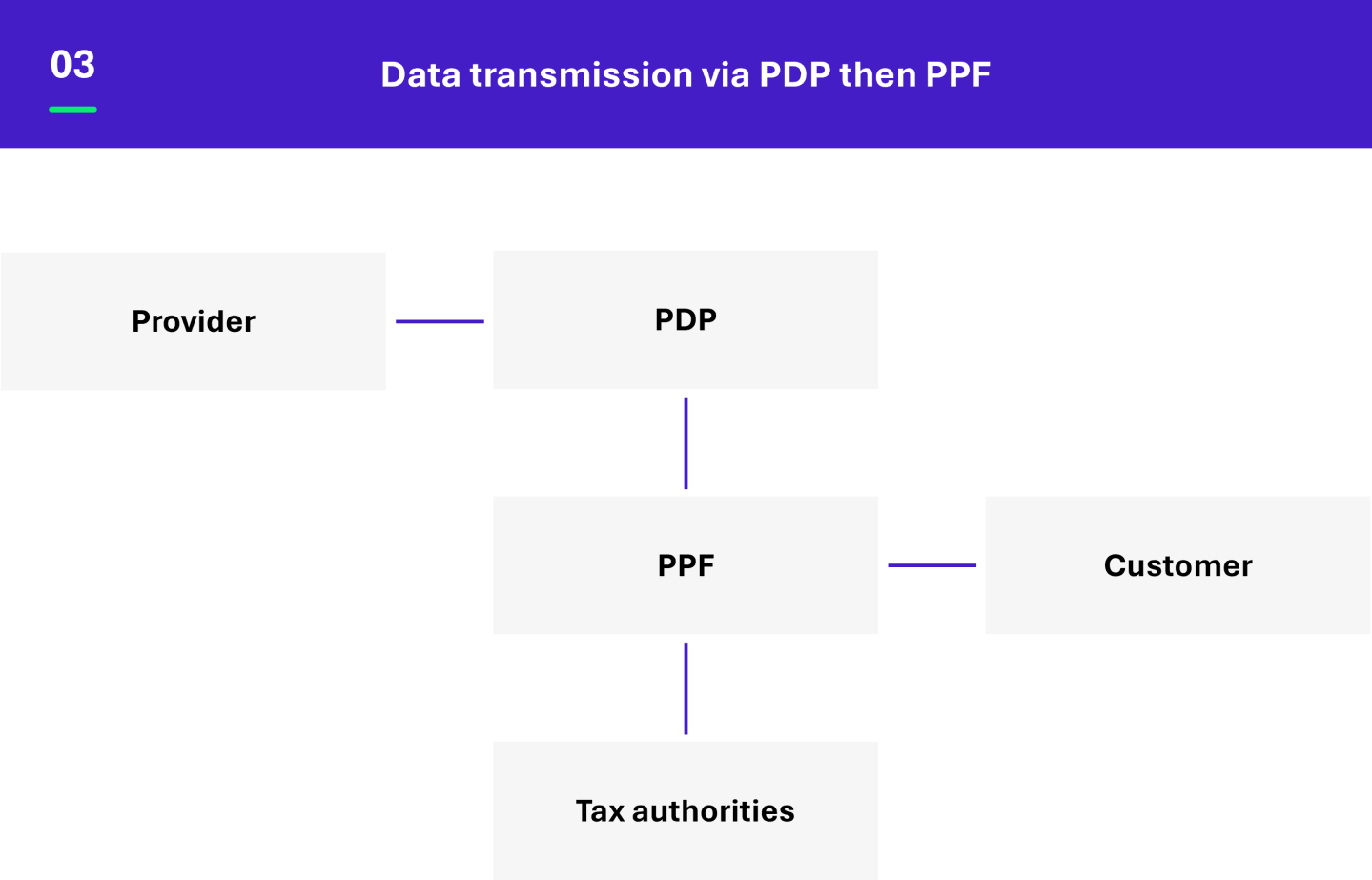

3. Data transmission via PDP then PPF

The supplier uses a PDP to issue an invoice. The PDP sends this invoice to the PPF and forwards invoicing data to tax authorities. The PPF hands over the invoice to the customer.

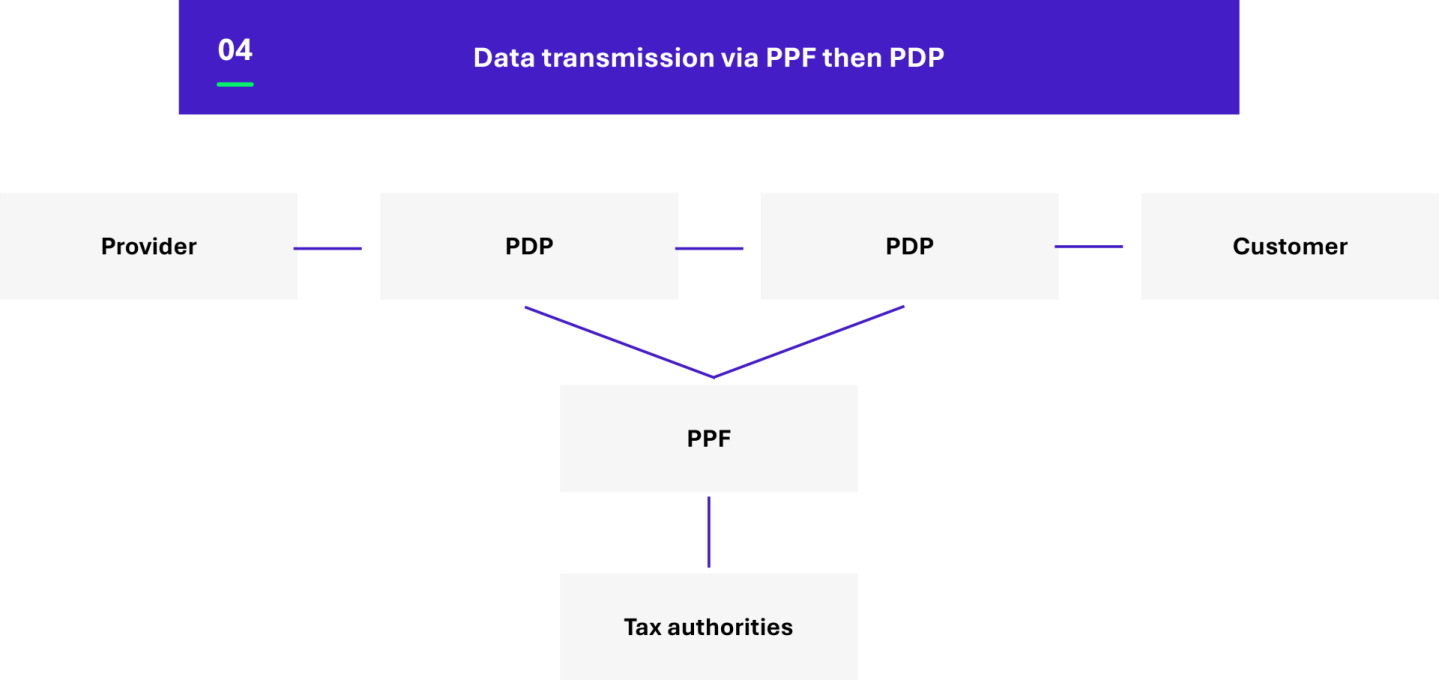

4. Data transmission via PPF then PDP

The supplier issues an invoice via a PDP. This PDP sends the invoice to the customer’s PDP and forwards invoicing data to the PPF. The PPF forwards invoicing data to tax authorities. The customer’s PDP sends the invoice to the customer.

How to go paperless?

Our tips for tackling the reform:

- Clearly identify the scope impacted: invoices subject to VAT, incoming and outgoing flows, operations in France or abroad.

- Evaluate the level of criticality in relation to the company’s core business: indirect purchases vs. goods or production purchases, invoices from key accounts vs. small business customers, invoice volume, etc.

- Factor in the maturity level of current invoice management processes: What steps need to be taken to bring practices and resources in line with legal requirements? What are the consequences for existing supplier and customer accounting departments?

- Choose the best e-invoicing solution: PPF or PDP? A PDP partner to cover only fiscal requirements (invoice transmission and e-reporting), or an e-invoicing solution with comprehensive business functionalities (workflows, reporting, analysis)?

Author

-

Fabien Raymond

Senior Manager – France, Lyon

Wavestone

LinkedIn