8 roadblocks slowing innovation’s speed to market

Published April 10, 2025

- Business Strategy & Transformation

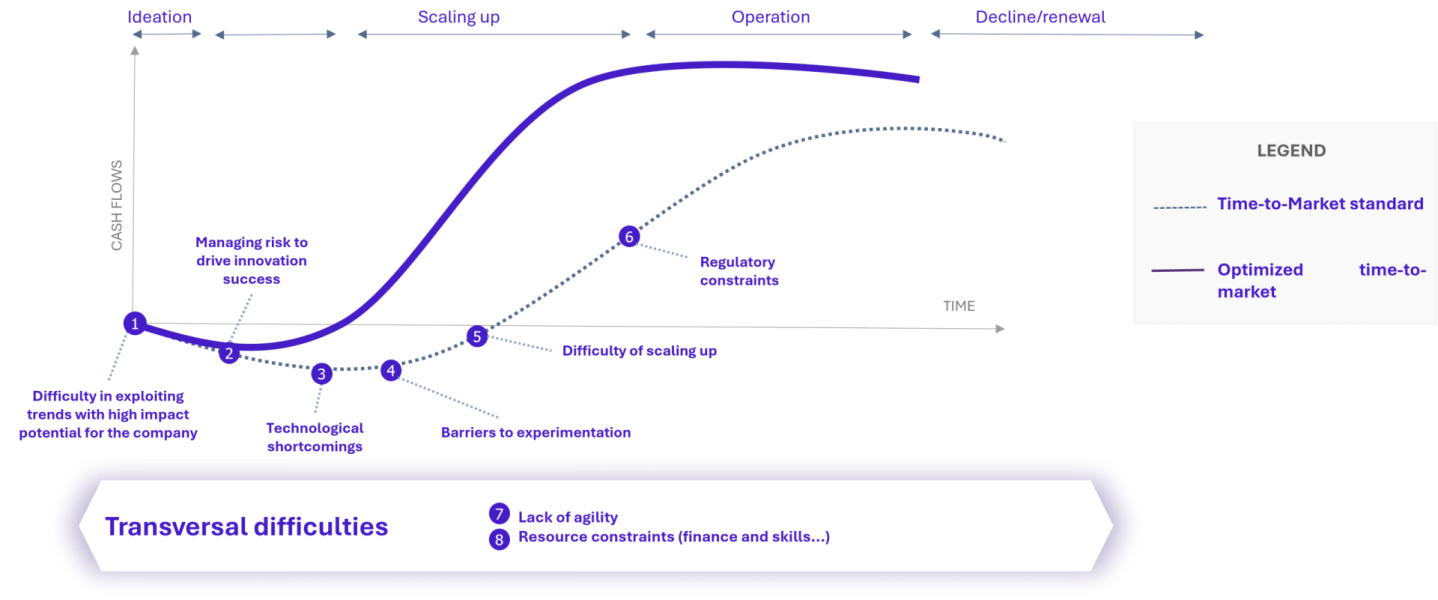

Innovation has become a key driver for large companies, no longer a choice but a strategic necessity to stay competitive. Success depends on delivering innovation quickly, making time-to-market crucial. Yet, companies across sectors face common challenges in bringing ideas to life.

Drawing from Wavestone’s experience and interviews with innovation leaders from major global organizations, we’ve identified (8) key barriers that slow down innovation’s journey to market. In this document, we share practical solutions and best practices to overcome these strategic, cultural, and regulatory hurdles.

Optimizing time-to-market at the R&I

The 8 key challenges companies face in speeding up the time-to-market for innovation

The acceleration of technological cycles and the proliferation of trends (technological, societal, environmental, regulatory…) can rapidly take companies by surprise. With the growing volume of information, identifying relevant and useful data is becoming increasingly challenging, often leading to time-consuming and resource-intensive efforts.To meet this challenge, monitoring and scouting departments are being set up within major groups, with processes put in place to continuously research, analyze and exploit information. While this involves diversifying intelligence channels, taking part in events and developing partnerships, many efforts are currently being made to automate this process. The use of artificial intelligence (AI) is becoming increasingly widespread, notably to accelerate and enhance data processing and analysis —such as analyzing regulatory texts, summarizing scientific or trend reports, automating competitive environment screening, or reviewing patent filings.).

The ability to identify trends with significant medium- and long-term impacts, whether positive or negative, has become a new challenge. Foresight approaches, which are increasingly adopted, rely on collective expert insights to build scenarios that represent possible futures for the industry and the company’s role within them. These scenarios, based on assumptions about trends like technological advancements, regulatory shifts, and consumer behavior, help pinpoint risks and opportunities. By mapping out a clear roadmap, companies can plan strategic decisions and innovation initiatives more effectively, identifying necessary assets such as technologies and skills.

However, with limited resources, the challenge lies in determining which scenarios—and thus, which trends—the company should prioritize. Option-based approaches are emerging, utilizing innovation portfolios tied to different scenarios. Instead of committing to one path, the company explores multiple scenarios simultaneously, regularly adjusting strategies based on feedback. By embracing optionality, the company remains flexible and responsive, allowing it to adapt quickly to changing conditions and capitalize on emerging opportunities.

Innovation efforts often face two critical challenges: misalignment with corporate strategy and desynchronization with business teams. Misalignment arises when innovation lacks clear priorities or fails to connect with strategic objectives. Strategic scoping and formalized processes ensure innovation efforts stay aligned, creating a clear link between strategy and execution.

Desynchronization can occur when innovation arrives too late, too early, or fails to adapt to shifting business priorities. To address this, companies are implementing processes that engage stakeholders early, define clear roles and responsibilities, and foster collaboration across teams. This approach balances structure with agility and is often supported by strategic portfolio managers who coordinate efforts and maintain alignment through regular reviews.

Finally, effective communication is essential to a successful innovation strategy. A clear and structured communication plan ensures the dissemination of strategic priorities, highlights innovation opportunities, and engages all employees—helping align operational teams and leadership around a shared vision.

Management often hesitates to commit to projects with uncertain outcomes, leading to the systematic undervaluation of “non-incremental” innovations—those with higher uncertainty but significant growth potential. To address this, companies are adopting structured approaches to manage the inherent risks across different categories of innovation.

This approach begins with identifying key risk criteria, such as commercial viability, acceptable financial exposure, feasibility, reputational considerations, and regulatory compliance. For each category of innovation, companies define acceptable, tolerable, and unacceptable levels of risk. These risk thresholds are then evaluated at each stage of the innovation lifecycle to guide decisions—whether to continue, pivot, or eliminate a project. Clear, stage-specific success factors are validated to assess a project’s progress and its ability to mitigate risk, ensuring that only projects meeting these criteria secure further investment.

Risk management extends beyond individual projects to the portfolio level, where a balanced approach is critical. This involves:

- Diversifying project categories: Balancing objectives, risk levels, and timelines across the portfolio.

- Maximizing volume: Increasing the total number of projects, particularly for non-incremental innovations, to improve the likelihood of identifying transformative opportunities.

Since future value creation is unpredictable at a project’s outset, the strategy emphasizes broad exploration followed by rapid selection of initiatives that demonstrate tangible contributions to value.

Finally, reducing risk means showcasing broader returns beyond economic outcomes. Projects should demonstrate impact in areas such as knowledge generation (e.g., patents, publications), skill development, and the adoption of new technologies—creating assets that contribute to long-term organizational growth and resilience.

Research and Development (R&D) is a cornerstone of innovation, driving the creation of technologies that enable new products, services, and business models. To deliver real value, R&D must align with the company’s core business activities or prepare it for future opportunities.

An effective R&D strategy requires clarity, agility, and alignment with the company’s strategic priorities across short-, medium-, and long-term horizons. Without this, R&D risks becoming misaligned with business evolution, leading to inefficiencies and missed opportunities. Co-creating business transformation trajectories tied to specific timeframes is critical for defining the technological needs that will support future growth. This process should leverage forward-looking “scenarios of the future” to ensure relevance and foresight.

Supporting medium- and long-term transformations also demands sustained effort and consistency. Stop-and-go investments and constant re-prioritization in favor of short-term needs can derail progress. Multi-year budgeting with dedicated funding envelopes by theme is essential to maintain focus and momentum.

R&D and innovation leaders must also address the critical question of a “make or buy” strategy to acquire the necessary technological assets. Building in-house solutions when external options exist risks overinvestment, delays, or failure to deliver. Conversely, relying on external partners requires robust processes to identify reliable collaborators and define effective partnership models.

Experimentation is central to innovation, enabling organizations to gradually reduce uncertainties around desirability, feasibility, and viability. While this practice is increasingly common, several barriers persist in the environments surveyed.

1. Methodology and testing frameworks

A key challenge lies in establishing a robust, shared methodology to:

- Identify the hypotheses critical to an innovation’s success

- Define how to test these hypotheses effectively

- Demonstrate the value created by the innovation

Experimentation also requires specialized testing environments—labs, sandboxes, or full-scale test sites—which can be difficult to implement due to regulatory constraints or challenges in scaling up.

2. Access to key assets

Accessing the resources needed for experimentation—such as end users, early adopters, or beta testers—often proves difficult. Collaboration with marketing or sales teams is crucial but can encounter resistance, particularly when economic outcomes are uncertain. These teams may prioritize meeting short-term targets over supporting innovation efforts. Early inclusion of business teams is essential to embed a culture of experimentation, secure buy-in, and facilitate adoption of the innovation.

3. Evolving processes

Outdated or inadequate processes often hinder experimentation. A common example is the difficulty of contracting with start-ups, which requires faster, more flexible frameworks. Some organizations address this by creating dedicated tools, services, or autonomous structures (e.g., economic interest groups or associations) to better support these partnerships.

Scaling up is a critical step in driving impact, but it often becomes a stumbling block for innovation. Without buy-in from operational teams, an appropriate operating model, sufficient resources, or strong management support, earlier efforts risk being wasted.

1. Early engagement with operational teams

Successful scale-up begins with involving operational teams from the outset. Clear roles, expectations, and handover plans must be established early. Collaboration is key to demonstrating the value of industrializing the project, ensuring teams see the benefit of investing in scale-up efforts. Proving the project’s value—both in terms of company impact and ROI—requires close alignment and co-creation with these teams.

2. Assessing scale-up readiness

A critical question is whether the project is truly ready for scale-up. The project team must demonstrate:

- A well-defined go-to-market strategy

- The feasibility of industrializing the technology

- A clear transition plan from project mode to operational mode

- The optimal scaling route (e.g., through an existing business unit, a new unit, or a spin-off)

A pre-scale-up phase is essential to validate these elements and address potential gaps.

3. Securing investment and sponsorship

When a project is ready to scale, the organization must be prepared to invest rapidly and significantly. A committed sponsor plays a pivotal role—not only in securing financial resources but also in providing strategic support. This is especially crucial for innovations that aim to transform business models, where leadership alignment and a clear vision are indispensable.

While market and technology intelligence activities are essential, legal intelligence is also central to innovation.

Misinterpreting or overlooking new regulations can lead to missed opportunities or project failures. Unfortunately, legal oversight often enters late in the innovation process, resulting in delays or, in some cases, project termination. To avoid this, legal monitoring must be integrated early and involve collaborative efforts with other teams.

The fast pace of innovation, particularly in regulated industries, creates tension between regulatory constraints and the need to experiment. To address this, companies can establish dedicated labs to manage regulatory risks and apply for sandbox environments, where innovations can be tested under controlled conditions without the full regulatory burden. Engaging regulators in these experiments allows for the potential adjustment of regulatory frameworks.

Finally, companies must anticipate how innovations might impact regulatory guidelines. Given the difficulty of foreseeing all future applications of new technologies, risk analyses can help by classifying use cases based on their risk levels. This approach enables more informed decision-making and smoother integration of innovations into business operations.

Lack of agility is a recurring challenge for innovation departments in major corporations. By nature, innovation can emerge anywhere in the company at any time, making agility essential to allocate resources at the right moment.

The budget allocation process often exacerbates this issue. Traditional budget cycles tied to the fiscal year make it difficult to invest in unforeseen projects during the year. To address this, many companies are adopting a “rolling roadmap” approach, which allows for flexibility to address short-term needs while maintaining the roadmap’s annual or multi-year framework. Regular reviews (3-4 times per year) and agile bodies, such as Product Increment Planning, ensure real-time visibility into resource consumption and forecasts. These mechanisms free up budgets from under-utilized or postponed projects, enabling the launch of new initiatives within the budget cycle.

Lengthy decision-making processes are another common complaint, often leading to decision paralysis. This can cause stop-and-go phases for projects that run out of budget despite delivering value or result in the inability to terminate low-performing projects, wasting valuable resources. This issue can be mitigated by validating specific key success factors at each stage of the innovation lifecycle, ensuring clear milestones for progression or termination. Introducing shorter decision-making circuits based on subsidiarity principles can further reduce delays.

Finally, organizational and team agility is critical. Beyond adopting agile methodologies, companies must deploy effective communication and synchronization tools, such as collaborative platforms, to ensure seamless coordination, even in geographically dispersed teams.

Access to corporate resources is a challenge for all departments, but it is particularly pronounced for innovation teams. Innovation projects, especially “non-incremental” ones, are often deprioritized in economically strained environments, making them the first to be sacrificed. To mitigate this, securing long-term resources is essential. Dedicated budgets for specific projects, programs, or themes must be safeguarded, while leveraging diversified external funding sources (e.g., CIR, CII) can reduce reliance on internal budgets.

Another common challenge is mobilizing company assets. A best practice is the creation of “collaboration contracts” between innovation project teams and operational/support teams. These agreements anticipate asset requirements, align teams, define roles and responsibilities, and establish operating rules. Some companies make such contracts a prerequisite for committing to a project.

A frequently strained resource is the availability of “intrapreneurs”—employees capable of driving in-house innovation projects. These profiles are rare and often difficult to mobilize, as direct managers may hesitate to release them. Moreover, while leading an innovation project is motivating for these individuals, traditional career paths and reward systems do not adequately recognize their contributions. Objectives and promotions are typically tied to market success, which remains uncertain in innovation. Rethinking HR strategies is crucial, including creating new career paths that value innovators’ contributions, support talent recruitment, and incentivize entrepreneurial profiles.

Conclusion

The obstacles to innovation’s Time-to-Market (TTM) are deeply interconnected, requiring a holistic approach to address them effectively. Optimizing TTM cannot depend on a single lever but demands a coordinated set of actions. A comprehensive 360° strategy is essential to conduct a thorough diagnosis, identify interdependencies, and implement a targeted, actionable plan for success.

Thanks to Anais Etemad, Maryline Meilland, Laura Dupuy, Angeline Renaudin, and Marko Yaccoub for contributing to this article.