Supply Chain, Planning and Environment

Published November 29, 2024

- Supply Chain

- Sustainability

Supply Chain in turmoil

Supply chain is at the center of attention and a priority for many players today, be they politicians, economists, investors or business leaders. Today, more than ever before, it is called upon to act swiftly and concretely to address current realities.

- Environmental protection: Through the need to significantly reduce carbon emissions, waste and energy consumption.

- Global economy: Through the various economic, health and geopolitical crises (shortage of raw materials, changes in transport routes and delays, inflation, etc.). Today’s motto is VUCA (Volatility, Uncertainty, Complexity, Ambiguity), making long-term supply chain strategies and planning somewhat tricky: should businesses relocate for example, or decouple their supply chain links by geographical zone? In this context, managers are looking for greater adaptability and responsiveness.

- Digital context: The supply chain, like most other industries, is experiencing an unprecedented digital revolution, through large-scale digitization and new disruptive technologies such as Artificial Intelligence and operational robotization.

Torn in three directions, the global supply chain needs to prove more agile and resilient. Harmonizing its various activities could give it significant leverage for innovation and action in the face of these major challenges, particularly the ecological one.

Tougher regulations

Current efforts to reduce GHG emissions focus mainly on two levels of the supply chain.

- At operational level, practical initiatives are implemented, such as optimized transport schedules, improved truck filling, backhauling etc, thanks to increasingly high-performing tools.

- At a strategic level, companies are addressing environmental issues, for example when defining logistics master plans or optimizing “road-to-market”, by anticipating each scenario’s potential footprint before implementation.

We note that from a tactical standpoint, efforts lack substance and tend to stick to reporting and analysis. The latter remain theoretical and fail to drive concrete decisions and actions looking forward.

It’s therefore time to integrate a new dimension into supply chain planning, namely the ecological dimension, all the more so as, since January 1, 2024, companies with more than 500 employees and head offices in Europe are required to adopt and disclose a new ecological and social reporting system (the CSRD, Corporate Sustainability Reporting Directive) in addition to conventional financial reporting. This will eventually apply to all companies operating in Europe by 2028.

This dimension should be integrated at all levels of supply chain planning, to ensure consistency between operations management’s focus on volume, finance management’s focus on value, and CSR management’s focus on ecology. This starts with the S&OP (Sales & Operations Planning) process.

Towards a 6th S&OP maturity level

Historically, there have been 5 levels of S&OP maturity:

- No predefined objectives, steering is based on reaction to events.

- Sales forecasts, mainly focusing on demand

- End-to-end load-capacity matching through simple dashboards (integrating workload, production and procurement)

- Standard routines, scenario and decision support tools (Advanced Planning and Scheduling) with simulation and optimization capabilities

- Full financial integration and business model behind every S&OP decision

A sixth level is a natural addition: environmental sustainability.

4 steps to greater maturity

Teams’ awareness should be raised, laws and standards unpacked, and key indicators defined.

New standards and directives, particularly from the European Union, mean that targets and requirements are always changing. The most recent of these is the CSRD (Corporate Sustainability Reporting Directive), which came into force on January 1, 2024, and will apply to large companies and unlisted SMEs by 2028.

This directive is intended to put financial and non-financial reporting at the same level, and thus entice investors to commit to environmentally responsible companies.

To this end, the CSRD introduces the concept of “double materiality assessment”: while companies previously only had to consider how their activities across the entire value chain impacted people and the environment, they must now assess how sustainability issues and the environment can financially affect the company. What’s more, these analyses’ framework will now be standardized for all companies. This new benchmark, more comprehensive than the carbon footprint or the GRI (Global Reporting Initiative), will enable stakeholders to better assess and compare companies’ sustainability performance.

The process for carrying out the double materiality analysis involves, firstly, identifying those criteria deemed to be material to the company, in addition to the European Sustainability Reporting Standards (ESRS) created by the CSRD. Secondly, the relevant data is collected. Finally, analysis and prioritization of this data reveals the criteria’ materiality threshold.

As the CSRD is a reference framework for analysis, it doesn’t require companies to meet quantified targets. They will merely be required to present action plans to meet the challenges raised by criteria identified as material.

The overall cost of this process has been officially estimated by the European Commission at 3.6 billion euros per year for all companies.

For example, to estimate the mass of microplastics generated and used, a company has to assess their origins. Here is a non-exhaustive list of microplastic sources within the supply chain:

- Polypropylene, polyethylene and polystyrene used for packaging

- Damage to logistic truck’s tires

- Container ships’ paintwork and its degradation

- Plastic granules lost in transit

Here, each source should be sorted according to its relative importance. The aim is not to weigh everything up to the nearest gram, but to provide a reliable appraisal of the company’s CO2 emissions.

It is also important to differentiate between produced and used microplastics:

- Generated microplastics are the result of the company’s activities (indirect).

- Used microplastics are consumed by the company, in particular for packaging (direct).

Companies should also aim for almost-automated metrics to feed KPIs with dynamic or automatic updates.

Data collection will involve the whole company, as well as its stakeholders, as ESRS criteria cover all aspects of the value chain and its impacts. Qualitative and quantitative criteria will be listed by an EU body, in addition to company-specific criteria. Companie already steering standards such as the carbon footprint or the GRI will be able to reuse this data for some of the CSRD criteria.

TMS (Transportation Management System) / WMS (Warehouse Management System) solutions will be useful when estimating this kind of indicator: for example, total length of truck journeys made by the company’s transport operations can lead to an estimate of the number of microplastics generated by tire wear, once the emission of microplastics per tire per kilometer has been estimated. A standardized method for estimating this emission rate will be included in the forthcoming Euro 7 standards, due to come into force in 2026-2027.

Data can be structured and aggregated in a number of ways:

- Geographically (by country, region)

- By product family

- By site (factory, warehouse, store, etc.) By transportation mode (truck, container ship, etc.)

Here, the most relevant should be identified to best capture the main sources of microplastic emissions and uses.

S&OP bodies should be restructured to include the CSR Officer, and decision-making mechanisms defined in conjunction with general management.

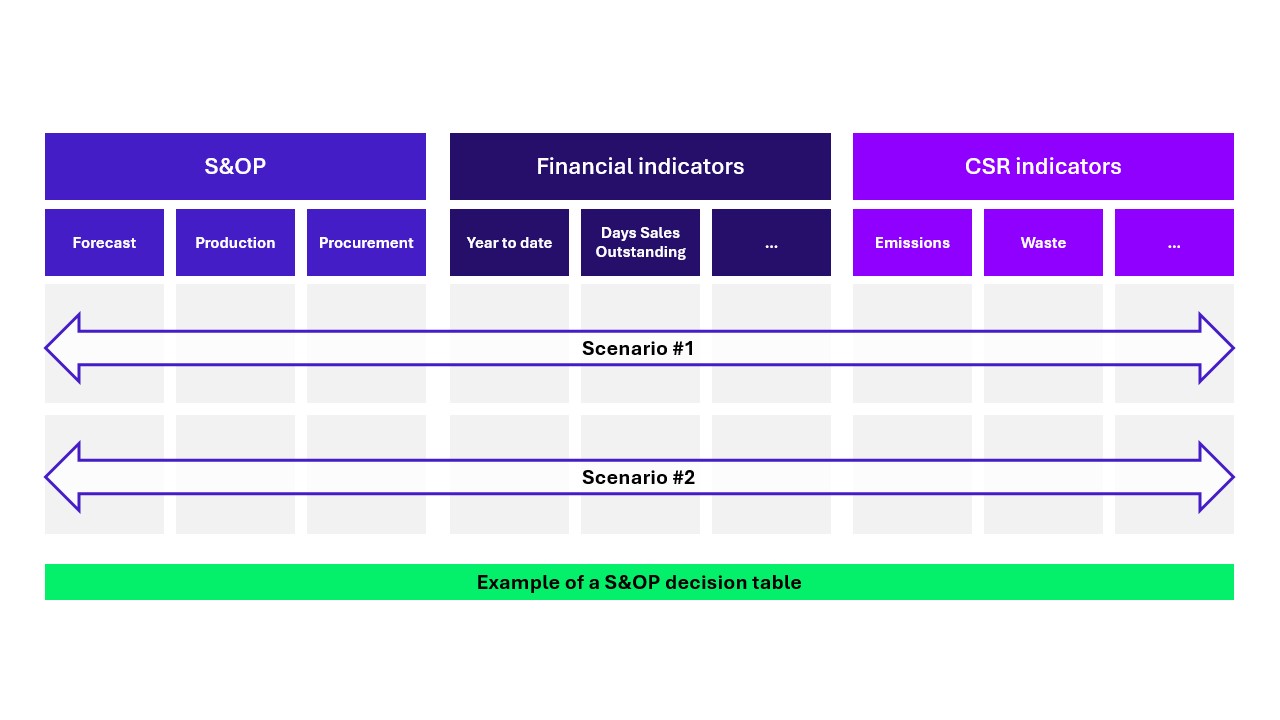

The simplified diagram below illustrates, in the third column, how CSR issues are now being taken into account within the S&OP, in particular as a result of the new CSRD regulation. As a result, S&OP adjustments can be directly monitored in regard to their impact on CSR indicators.

In this way, the tactical level would include responsible planning and concrete actions.

With the goals, requirements and data now clear, APS (Advanced Planning & Scheduling), steering and execution tools need to be adjusted to ensure proper implementation and, above all, compliant reporting according to current standards and regulations.

Conclusion

C-S&OP ©, for “Carbon S&OP” (if we may call it this way), offers a new vision and, above all, proactive and tangible measures. Clearly, a major change management challenge is ahead, but the climate emergency demands that it be rapidly integrated into an overall approach, and not into an opportunistic logic, as can be seen today in the implementation of cross-subsidiary or global S&OPs, which are mainly motivated by a purely financial logic of balancing between subsidiaries and securing supplies, relegating the CSR logic to the background.