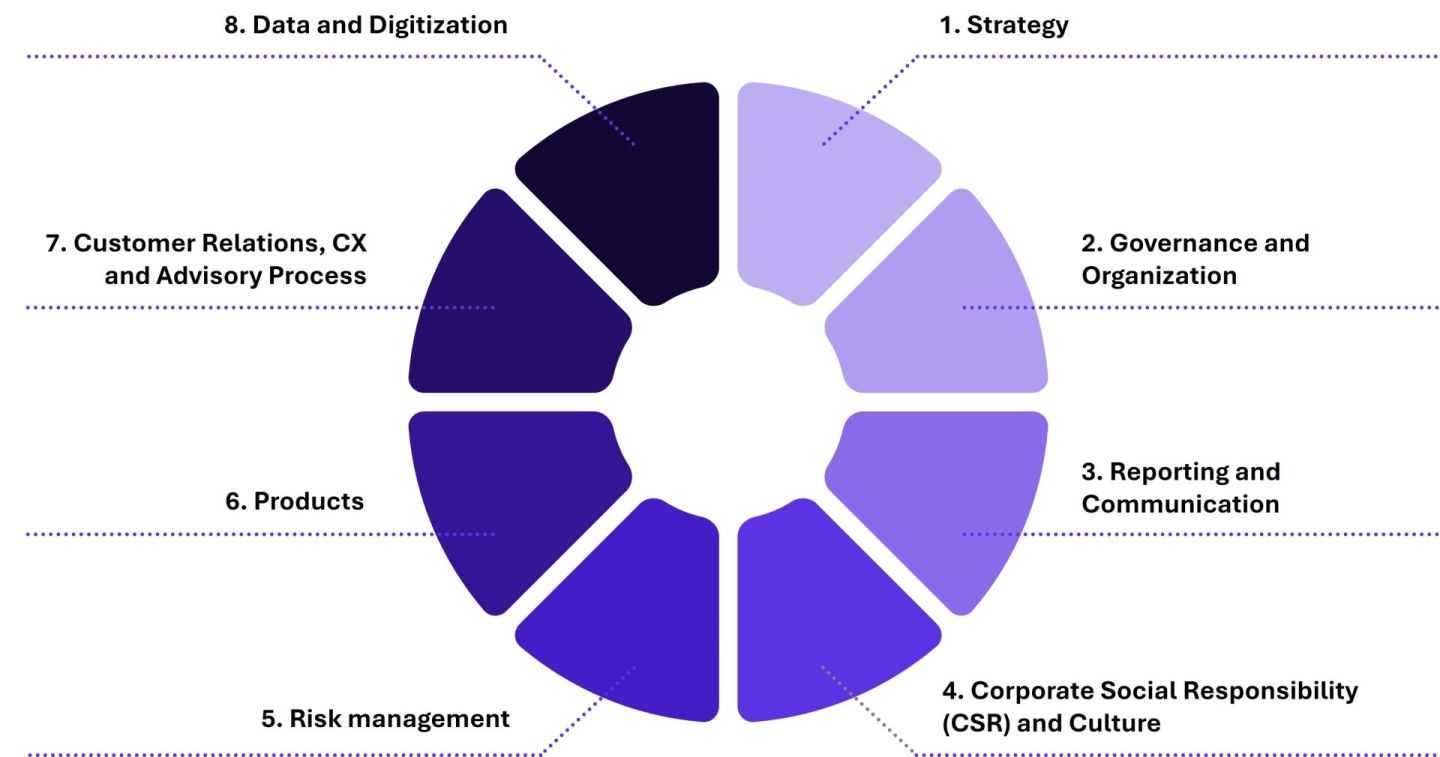

Sustainable finance: 8 dimensions of sustainable transformation

Published February 16, 2024

- Banking

- Sustainability

Sustainable finance is rapidly emerging as a key strategic priority for financial institutions. Whether leading the way or responding to regulatory requirements, the integration of sustainability and ESG criteria into business models and processes has become inevitable for financial institutions of all types. This article examines the key dimensions of this transformation process.

The first fundamental step is to look at the company’s overall strategy. Do you want sustainability to become your hallmark and attract new customers? If so, you’ll need to fundamentally rethink your business model and adjust your corporate strategy accordingly. This raises key questions: Which external commitments (e.g. Principles of Responsible Investment, Net-Zero Banking Alliance) do you want to sign and how will you implement them? What KPIs and sustainability indicators do you need? Are you aiming for minimum compliance or do you want to go beyond standard requirements? Often it is sufficient to develop, implement and publish a sound sustainable investment strategy, while meeting minimum reporting requirements. Each company needs to define its own optimal strategy, as requirements and circumstances vary widely.

The organizational implementation of a sustainability approach is a key factor that can be structured differently depending on the size of the company and its strategic priorities. Key questions include: What roles and committees are needed? Is it beneficial to have a centralized expert unit reporting directly to the CEO? Or should experts be placed in all departments to drive the transformation in a decentralized manner? Answering these questions is critical to successful implementation, and the actual implementation effort will largely depend on the strategy chosen.

Reporting requires a thoughtful strategy: What reports are required for compliance at the product, customer, and corporate levels (e.g., GRI, SASB, UN Global Compact)? What are the existing or emerging regulatory requirements (e.g., TCFD) and deadlines? Does in-house reporting make sense, or would outsourcing ESG reporting be more cost-effective?

Marketing and distribution raise additional questions: Should sustainable investments be proactively positioned with clients, or is internal staff training sufficient for client-initiated discussions? Are specific ESG sales or training initiatives planned? Can sustainability be leveraged to increase attractiveness to customers and potential employers?

Credibility requires robust risk management and effective controls, including both framework and operational risk management. Key questions include: What risks should be measured and what’s the initial focus? Which of these are material? How do pension funds and insurance companies address the risk of being stuck with illiquid commodity holdings? How can sustainability issues be appropriately considered in the credit approval process?

Operational risk management faces additional challenges: What additional scenarios are needed for ESG-enhanced stress testing? How do early warning systems and loss databases need to be adapted? How can risks and controls be documented in an audit-proof manner?

Innovative products and services are a key competitive differentiator. How can banks ensure they appeal to the next generation? Sustainability opens up new business opportunities, such as green credit cards or mortgages. Integrating sustainability into research, investment strategy and security selection is crucial.

Increasing market transparency requires a clear and understandable presentation of investment strategy and security selection in prospects – regardless of the size of the bank. How can this be done in a way that is customer-oriented and differentiating from the competition? A particular challenge is the sustainable and yet return-oriented investment of pension assets.

Integrating sustainability into the advisory process is becoming increasingly important. How can sustainability interests be captured and documented during client acquisition? Is it necessary to customize the advisory process for ESG issues, or is a modular approach for different client interests sufficient?

What channel works best: face-to-face advice or digital tools/apps? Does it make sense to customize reporting based on ESG preferences? How do you ensure that advisors have sufficient sustainability knowledge and can confidently apply it in client discussions? Is there value in offering sustainability education to clients?

A solid data foundation is essential for sustainability and ESG. Should the IT infrastructure be upgraded to gain a competitive advantage? Without a good data model, the wealth of ESG data cannot be integrated and leveraged. Analyzing data needs and identifying data providers is critical.

Data must be processed so that all departments – research, portfolio management, risk management, and sales – can understand and use it efficiently. Combined with AI, client behavior and sales potential could be improved. Can the database be used for advisor training and client information? Could FinTech’s provide attractive, fast external solutions? Modern technology allows for largely automated reporting to minimize effort.

The transformation doesn’t have to encompass all dimensions simultaneously – it makes sense to start strategically with key areas. This can be done with internal expertise or external support. External support is particularly valuable for the initial neutral analysis, roadmap development, and prioritization of issues. Later, external facilitators and subject matter experts can provide additional guidance during the transformation process.

Sustainable finance and ESG will become increasingly important. All companies, not just financial services providers, need to increase process transparency to remain competitive. Europe is an international leader in regulatory development. This provides an opportunity to proactively integrate fundamental requirements into day-to-day business operations, rather than reacting later under time pressure.

The 8 dimensions and their key questions form the basis of our ESG Maturity Model. Want to know where you stand? The ESG Maturity Assessment is the ideal starting point. You can conduct this preliminary analysis comprehensively across all dimensions or focus on selected areas. The rapid analysis has three objectives: to identify specific improvement opportunities in your core dimensions, to recommend prioritization of next steps, and to develop a coordinated roadmap for your sustainable transformation – both in terms of timing and content.

Author

-

Marion Ehringhaus

Principal Consultant – Switzerland, Zurich

Wavestone

LinkedIn